Medicare Supplement/Medigap

In speaking about Medicare, we understand the coverage’s for Medicare Part A and Part B. As we discovered, many things are missing. Medicare supplements were built to supplement the benefits that Medicare offers and fill in the gaps for the missing pieces.

Please note, a Medicare supplement policy only covers the specific coverage’s that are covered by Medicare and supplements the coverage’s that original Medicare parts A and B covers. Things like dental, vision, hearing, and prescription drug coverage, like original Medicare, are not covered under a Medicare supplement plan unless, like Medicare, it is a medical procedure. For example, if a person has cataracts or glaucoma, and needs a medical procedure for this issue, this would be covered by Medicare, and if you have a supplement, will also be covered by the supplement up to policy coverage amounts.

Medicare supplements are federally regulated programs run by private insurance carriers. This means that a plan through one carrier always has the same benefits through another carrier. There are a few differences allowed by the federal government to be different between one company and the next. The differences are; the name of the insurance carrier that offers the plan, the price of the policy and in some instances a household discount. Some insurance companies also offer discount programs for supplemental benefits like dental, vision, and hearing.

What is a Medicare Supplement/Medigap?

Medicare Supplement Insurance, also referred to as Medigap insurance policy, is a form of private health insurance that works alongside Original Medicare Parts A and B. This coverage helps pay for out-of-pocket costs not covered under Original Medicare, including copayments, coinsurance, and deductibles. Medicare Supplement insurance policies are federally regulated insurance policies sold by private insurance companies. Medicare Supplement Insurance policies work like Original Medicare in that there is no network of doctors that you are required to see. Typically, any doctor that will accept Medicare will also accept a Medicare Supplement.

Benefits of a Medicare Supplement/Medigap Insurance Policy

Having a Medicare Supplement/Medigap insurance policy will help a Medicare-covered individual with better planning financially as to the potential healthcare costs that may arise. Original Medicare has copayments, coinsurance, and deductibles. At the same time, a Medicare Supplement also may have copayments and a deductible. The costs that may arise are significantly less than what potential loss may be with Original Medicare. This will ensure a more financially secure future, as a known possible out-of-pocket cost is essential when going into retirement years. Medicare Supplement insurance will give a Medicare-covered individual, a more specific cost-sharing potential out-of-pocket cost than any other Medicare insurance coverage will offer.

Another great benefit of Medicare Supplement insurance is that there is no network of doctors. This will give the policyholder the ability to choose their healthcare providers and ensures that they receive the best healthcare available to them.

Who is eligible to apply and when can you apply for a Medicare Supplement/Medigap insurance policy?

A Medicare-covered individual has the option of purchasing a Medicare Supplement. This can be done when a person initially becomes eligible for Medicare parts A and B. In most states, it is a requirement for a person to have both Medicare parts A and B to qualify for a Medicare supplement. Medicare supplements have an open enrollment period, in which an insurance company offering the product has a requirement to accept the Medicare-covered individual, no matter the health condition of the individual applying. The Open Enrollment period for Medicare Supplements begins the month a person first becomes eligible and enrolls in Medicare parts A and B, and lasts for six months after their month of eligibility.

Another enrollment period offered to a Medicare-eligible individual is called a Guaranteed Issue period. This period is a time that the insurance company is required to accept a Medicare qualified individual without requiring a health underwriting assessment. This enrollment period can happen for many different reasons. One of the reasons this period happens is that a Medicare qualified individual doesn’t need coverage from one of the parts of Original Medicare yet. The individual would have had health coverage through an employer group health plan that was by Medicare’s terms of credible insurance coverage. In this situation, a person can hold off on applying for one or more of the parts of Original Medicare and wait until they lose their coverage through the employer to apply for the coverage of Original Medicare. If the eligible individual had this scenario and applied for original Medicare after they lost their employer group health coverage, they would have a guaranteed issue period. During this period, a Medicare Supplement insurance company will have the requirement of accepting the individual without requiring a medical underwriting process. For this specific scenario, the individual has up to 63 days from the date the coverage from their employer is ending to apply for a Medicare Supplement and be offered guaranteed issue rights. (There are other reasons as well why a person would qualify for guaranteed issue right, and we suggest you call us for more details.)

After these specific periods, the insurance company will ask a series of medical history questions to determine if they want to cover the individual applying for coverage. Each insurance company can have different requirements for how stringent they want to be with the health questions they ask. This process is called medical underwriting, and the insurance company will review the medical history of the applying individual to determine if they are a good enough fit for the company they are applying to.

How does a Medicare Supplement work?

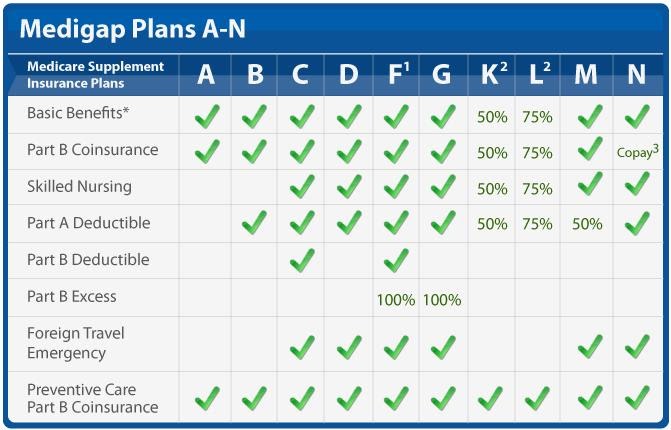

A Medicare Supplement policy is an insurance contract between the insurance company and the policyholder. This contract has specific costs that are placed on the policyholder. The expenses that are the policy holder’s responsibility are reflected in the contract policy’s terms of coverage pages. These terms can vary by which plan a customer chooses. Typically how it works is, there is a premium that is set and can be paid annually, semi-annually, quarterly, or monthly. This premium typically lasts for one calendar year and will adjust based on the age of the policyholder. The policy is always guaranteed to renew as long as the premium is paid. There are other ways an insurance company can adjust a premium as well, and this is also written in the insurance contract. Once the premium is paid, in the event of a policy-owners use of covered medical benefits, the insurance company has the requirement to pay the stated coverage amount, up to policy allowed amounts, per insurance claim. This is after the policy owner has sufficiently paid their required out-of-pocket amounts, per policy specifics. These costs can vary per policy, and typically will be in the form of a copayment or deductible, and is mentioned in the policy’s terms of the contract. Please see the chart below for specific coverage’s offered as Medicare Supplement insurance policies.

Please note, a Medicare supplement policy only covers the specific coverage’s that are covered by Medicare, and supplements the coverage’s that Original Medicare parts A and B covers. Things like dental, vision, hearing, and prescription drug coverage, like original Medicare, are not covered under a Medicare supplement plan unless, like Medicare, it is a medical procedure. For example, if a person has cataracts or glaucoma, and needs a medical procedure for this issue, this would be covered by Medicare, and if you have a supplement, will also be covered by the supplement up to policy coverage amounts.

Medicare supplements are federally regulated programs run by private insurance carriers. This means that a plan through one carrier always has the same benefits through another carrier. There are a few differences allowed by the federal government to be different between one company and the next. There are several key differences: the name of the insurance carrier that offers the plan, the price of the policy, and in some instances, a household discount. Some insurance companies also offer discount programs for supplemental benefits like dental, vision, and hearing.

Insurance Carrier

A person looking at purchasing a Medicare supplement, should look at the name of the insurance company offering the plan, and determine how long they have been in business and their financial standing in the insurance marketplace. This information is essential, as you will want to establish and ensure that the company you choose will be there for you when you may need them, years down the road.

Price of the Plan

Of course, the price of the plan is always a factor, but you should be cautious not only to shop based on price. Shopping price from the beginning could cost you later on in your premium rate hikes. Establishing a carrier that has a long-standing history in the business, and that does not have a history of spiking premiums on existing policyholders. We will talk about costs and coverage, which will help you understand the potential costs of owning a Medicare supplement.

Household Discounts

Some companies have discounts for living with others. The discount is different with each carrier. Some offer discounts for just living with somebody in your household that is over 60 years old, while other carriers require both people to have a policy through their company. Please ask one of our agents to explain these potential discounts.

Below is a chart of Medicare supplement plans offered. It shows all of the different Medicare supplement plans available. The most popular plans insurance carriers typically sell, are plans F, G, and N.

Beginning in January 2020, plans C and F will not be available for sale to new Medicare-eligible enrollees. The reason for this is, Congress signed a law called The Medicare Access and CHIP Reauthorization Act of 2015. The new law prohibits insurance carriers from offering newly Medicare-eligible individuals, plans that cover the Medicare Part B premium. Newly Medicare Eligible enrollees and individuals desiring this type of coverage are not going to be able to purchase plans with this benefit after December 31, 2019. Individuals that are currently enrolled in these plans will be able to keep their coverage going forward.

Plans F, G, and N are great coverage, but there are still those missing pieces we spoke about earlier (Dental, Vision, Hearing, and Prescription Drug Benefits). In addition, besides the monthly premiums involved with a Medicare Supplement, keep in mind the potential out of pocket cost associated with Medicare supplement plans. These include the following:

- Plan G’s Medicare Part B deductible.

- Plan N’s Medicare part B deductible, potential $20 doctor’s office co pays, and $50 emergency room co pays.

The cost of Medicare Supplement varies by each insurance carrier. Medicare supplements are also priced on an as you age basis. Prices increase with the age of the individual but also can change for other reasons as well. Typically, there are three pricing structures associated with the costs of a Medicare supplement. While the coverage does not change, the price of the policy does. As you age, the price of the policy will be more costly. In addition to these guaranteed price increases, a company can also rate the average price of an area, and determine if their costs have significantly changed. If they establish a large change, the insurance carrier can request from the board of insurance in each specific state to increase or decrease the premiums across the board. The increases or decreases would depend on the state approving the insurance company’s request. If approved, the insurance carrier will be able to set a higher premium for the policyholders carrying their policies. This increase is in addition to the guaranteed increases set by the age factors.

Medicare supplement plans are a great option for individuals who would like to know their potential healthcare costs. With a Medicare supplement, the costs are simpler and more straightforward. The potential costs involved are the monthly premiums, deductibles, and co-pays associated with your plan, so planning for your healthcare costs can be more predictable with a Medicare Supplement.

Medicare supplements do not offer Dental, Vision, Hearing Benefits, or Prescription Drugs Benefits. While Dental, vision, and hearing benefits are important, many people find that they get by without them. Prescription Drug benefits, also known as Medicare Part D RX coverage, though, is vital. It is so important that Medicare will penalize a person for not signing up for the coverage. Please see our Part D section for further details or feel free to give us a call.

Medicare supplement insurance is a great option, and we encourage you to understand the benefits. Please always feel free to give us a call and let us provide you a quote for your Medicare Supplement policy. We always provide you with the most up to date information and coverage available. Also, we will help you understand the benefits and potential subsidies provided by your state and will help you determine the right coverage’s for you as an individual.

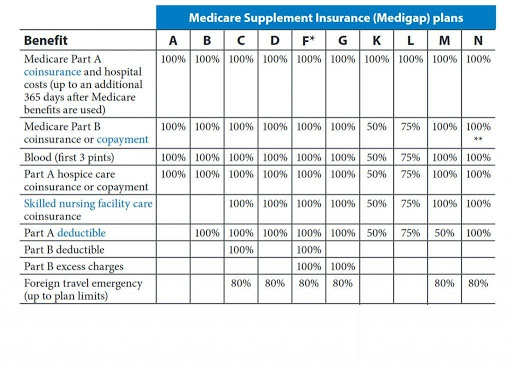

Here is another helpful chart as to the benefits offered in the most popular Medicare Supplement plans A through N.

Using this information, you can see that Medicare Supplements are rich in benefits. You will need additional coverage for dental, vision, hearing, and prescription drug costs. Contact us today for more information!

Using this information, you can see that Medicare Supplements are rich in benefits. You will need additional coverage for dental, vision, hearing, and prescription drug costs. Contact us today for more information!